FEDERAL RESERVE vs INFLATION

The Fed launched a war against inflation. One measurement shows they are winning, but two other measurements have stalled.

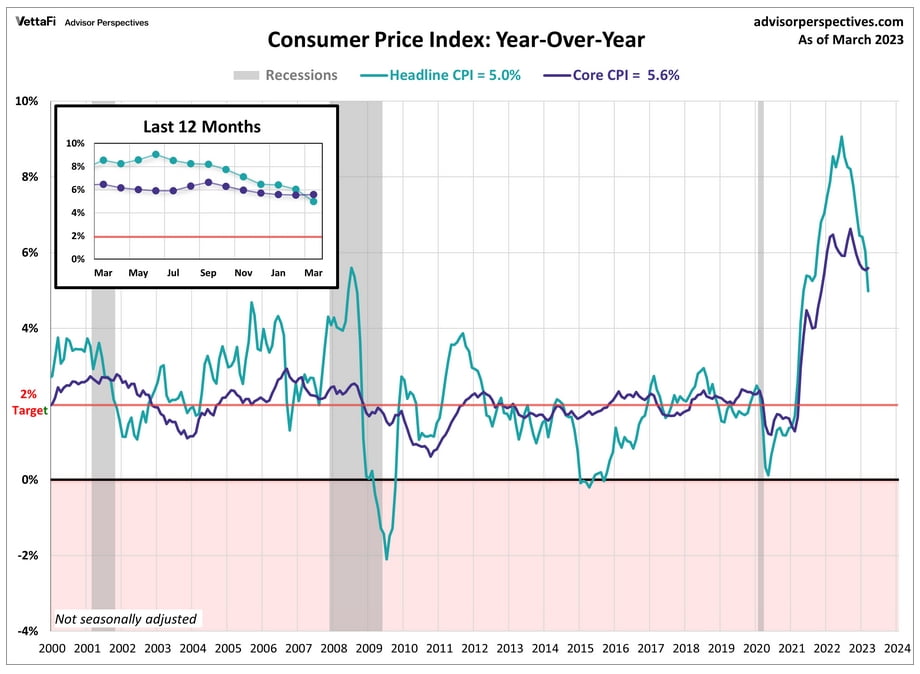

When the Fed declared war on inflation in March 2022, the Fed Funds rate target was 0.25% to 0.50%. Now, just 13 months later, after the fastest rate hike cycle in history, their target is 4.75% to 5.00%. Based on the large chart below, their plan seems to be “working.” The headline CPI number is crashing down from 8.9% in June 2022 to 5% last month. That alone is cause for celebration! However, take a look at the small insert chart titled “Last 12 months.” The Core (ex. volatile food and energy) CPI started to fall, but has stalled. In fact, although the Core CPI peaked in September 2022 at 6.6%, it has been stuck in a range of 5.5% to 6.6% for 16 consecutive months!

The Federal Reserve Bank of Atlanta has another “Core” type CPI known as the Sticky Price Consumer Price Index less Food and Energy. This inflation index is calculated from a subset of goods and services included in the CPI that change price relatively infrequently. This subset is thought to reflect future inflation expectations more effectively than the Core CPI.

The Sticky Price Core CPI broke above 6.0% seven months ago and has been averaging around 6.5% ever since.

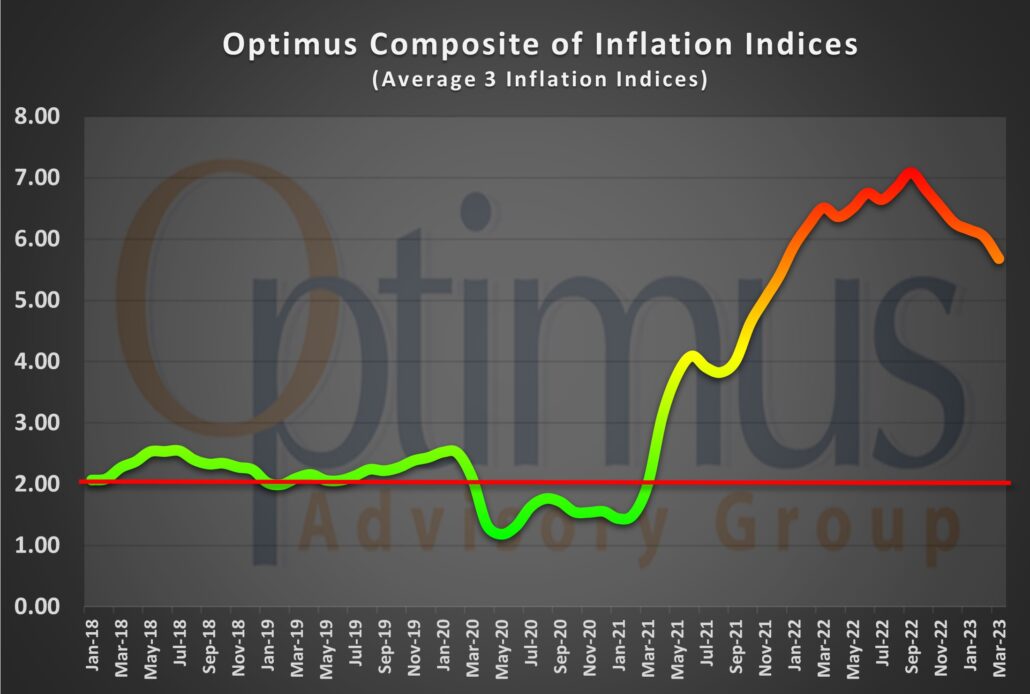

Average these three inflation gauges together for a clearer picture

As the chart below indicates, we have a long inflation-fighting journey still ahead of us. In fact, during the past 5-years, the only meaningful time we’ve enjoyed inflation below the Fed’s 2% target was during the first year of COVID-19. If the current trajectory stays constant, we’ll be well into 2024 before we hit that 2.0% Fed inflation target and be fortunate if we drop below 4.0% sometime this year.

The Fed is trying to strike the perfect balance between slowing the economy down just enough to crush inflation, but not enough to destroy the economy in the process. With a $26 trillion economy and 334 million people, we think the Fed will have its hands full trying to “stick the landing.”